Chinese brokers restrict cross-border swaps as stocks plunge | Reuters News Agency

[ad_1]

EconomyGovernment

05 February 2024, 9:36 pm 1 minute

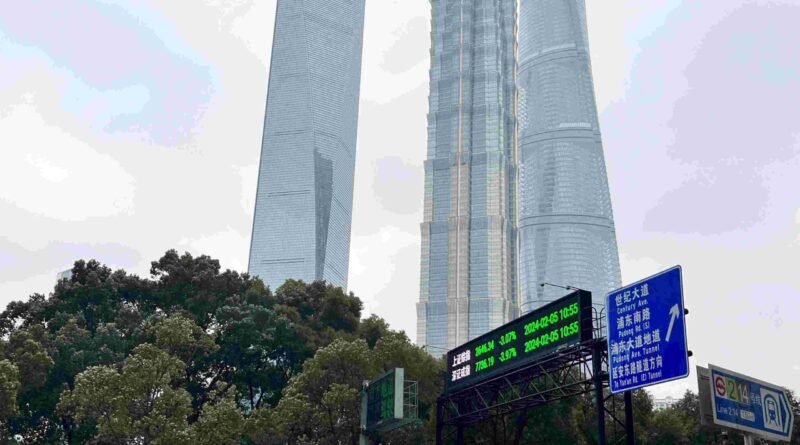

Reuters exclusively reported that Chinese brokerages, including state-owned behemoth China International Capital Corp (CICC), have restricted the amount of cross-border swap transactions domestic investors can undertake, as authorities seek to defend the weak stock market.

Market Impact

China’s blue-chip CSI300 Index (.CSI300), opens new tab tumbled nearly 5% last week to the lowest since early 2019, amid signs of panic selling and forced liquidation of leveraged trades. The outstanding balance of cross-border OTC derivatives at Chinese brokerages, including TRS and OTC options, amounted to 825.4 billion yuan ($114.7 billion) by the end of November 2023, up 8.5% from October, according to official data published by Chinese newspaper Securities Times.

Article Tags

Topics of Interest: EconomyGovernment

Type: Reuters Best

Sectors: Economy & PolicyFinancial ServicesGovernment & Public Services

Regions: Asia

Countries: China

Win Types: Exclusivity

Story Types: Exclusive / Scoop

Media Types: Text

Customer Impact: Significant National Story

[ad_2]

Source link